1997

Louis Dreyfus Group forms an energy merchant subsidiary.

CCI was established in 1997 as a subsidiary of the Louis Dreyfus Group and became Louis Dreyfus Highbridge Energy LLC in 2006. Acquired in 2012 by a group of private investors and management, the company was renamed Castleton Commodities International LLC.

Louis Dreyfus Group forms an energy merchant subsidiary.

Highbridge Capital Management LLC makes a significant minority equity investment in the Louis Dreyfus Group’s energy merchant subsidiary, forming Louis Dreyfus Highbridge Energy LLC.

Louis Dreyfus Highbridge Energy successfully monetizes its midstream energy asset portfolio.

Louis Dreyfus Highbridge Energy is acquired by management and a group of private investors. The newly established company is renamed Castleton Commodities International LLC ("CCI").

CCI acquires two gas-fired power assets, Rensselaer (NY) and Signal Hill (TX).

CCI acquires dual fuel-fired generation station Roseton (NY).

CCI acquires Morgan Stanley’s Global Oil Merchanting business, one of the world’s leading physical oil and products franchises.

CCI acquires certain East Texas assets from Anadarko, making it one of the largest independent gas producers in East Texas.

CCI acquires MaasStroom, a combined cycle power plant in the Netherlands and acquires a controlling stake in Delta-Energy Group, a green chemical company that converts end-of-life tires into specialty chemicals and recovered carbon black. Tokyo Gas completes a strategic equity investment in CCI’s upstream business, TG Natural Resources (formerly Castleton Resources).

CCI, as part of a JV, acquires a power portfolio from Eversource Energy and rebrands it Granite Shore Power. CCI acquires NorTex Midstream (TX) and a 50% stake in the Enecogen Power Plant (Netherlands).

CCI acquires Sherbino I wind farm (TX) and Mt. Storm wind farm (WV). CCI acquires Shell’s Haynesville assets through TG Natural Resources.

CCI acquires Bizkaia Energía, a natural gas-fired combined cycle plant in Spain. CCI acquires upstream assets in Northern Louisiana through TG Natural Resources, and concurrently with the transaction, reducing its ownership interest to 27%.

CCI monetizes NorTex Midstream, Mt. Storm wind farm, Sherbino I wind farm and Granite Shore Power. CCI reduces ownership interest in TG Natural Resources to 21%.

CCI makes two battery energy storage system (“BESS”) platform investments: a majority stake in S4 Energy BV (Netherlands) and Lower 48 Energy Ltd. (UK). CCI acquires a majority stake in combined cycle power plant New Salem Harbor (MA). CCI monetizes its Netherlands Power Portfolio.

CCI, through its subsidiary S4 Energy, acquires LC Energy's BESS platform (Netherlands) and a portfolio of BESS projects (Germany) from Terra One. CCI acquires power plant Hunlock (PA).

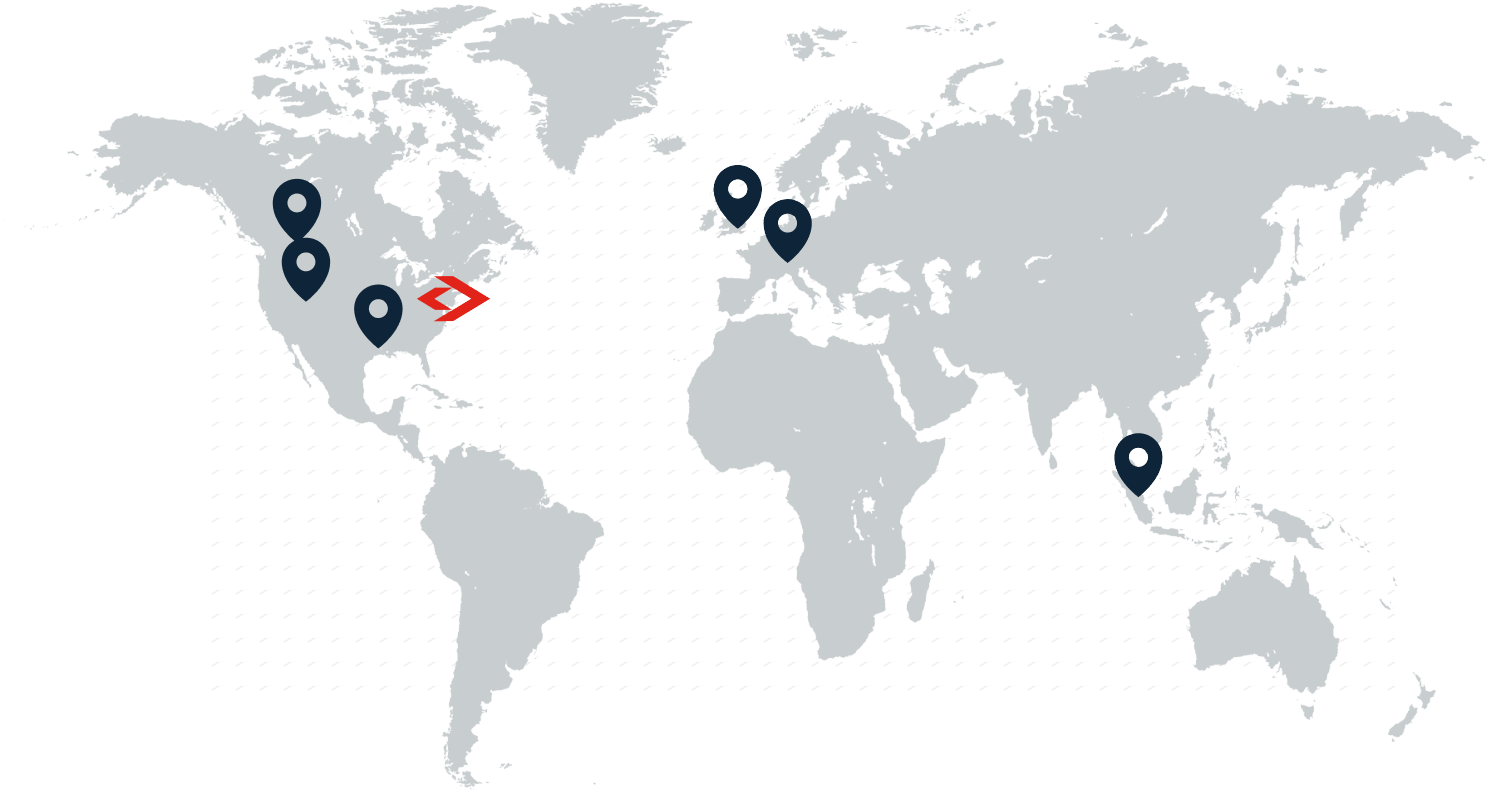

Headquartered in the United States, CCI conducts business around the world.

Learn more